Rising and decrease in cryptocurrency: Understanding the concept of capital’s return on capital (ROI)

Cryptocurrency, digital or virtual currency that uses encryption technology for safety has been a hot topic for many years. It was once considered a revolutionary concept that offered unmatched freedom and flexibility for people who invest their money online. Recently, however, the value of the cryptocurrency market has decreased significantly, leading to many investors to wonder if it is even worth investing.

In this article, we explore the world of cryptocurrency and explore how your investment yield or investment rate can be calculated in crypto.

What is the return on invested capital (ROI)?

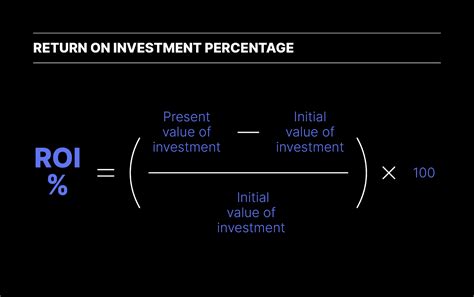

Investment income, also known as the return on capital (ROI), is an economic measure that measures the profitability of the investment. It is calculated by dividing the profits earned from the investments based on the original cost. Simply put, it is a relationship that shows how much more money you are than what was originally invested.

Why count ROI in cryptocurrency?

Calculating ROI in cryptocurrency is crucial for many reasons:

- Investment Decisions : Understanding ROI can help you make conscious investment decisions. If you are considering investing in cryptocurrencies, knowing the potential invested capital yield will give you a better idea of risks and rewards.

- Market Performance : Cryptocurrency prices may vary quickly, so calculating the return on invested capital is essential to understand how the investments have completed.

- Tax Efficiency : In some countries, cryptocurrency transactions are taxed differently than traditional financial instruments. Calculating ROI will help you optimize your tax efficiency.

How to calculate ROI CRYPTOCURRENCY

Calculate these steps in the cryptocurrency of the invested capital yield:

- Select cryptocurrency : Select the cryptocurrency you want to place and its current market value.

- Set the original cost : The original cost of buying or buying cryptocurrency may vary considerably depending on market conditions. The general approach is to use the reference price as the starting point (eg the highest ever in Bitcoin).

3

For example, assume that you invest $ 1,000 in Bitcoin at an all -time highest price of $ 30,000 and earn $ 5,000 winnings. The return on invested capital would be:

ROI = (profit / initial cost) x 100

= ($ 5,000 / $ 1,000) x 100

= 500%

Popular cryptocurrencies for investment

Here are some popular cryptocurrencies that are considered to be invested:

* Bitcoin (BTC) : First and most commonly recognized cryptocurrency.

* Ethereum (ETH) : A decentralized platform that supports the creation of smart contracts.

* Litecoin (LTC) : Peer -to -peer fishing technology, similar to Bitcoin but faster events.

Risks associated with the placement of Cryptocurrency

Although investment in cryptocurrency may be profitable, there are significant risks:

- market volatility

: The value of cryptocurrencies can vary quickly and unpredictably.

- Regulation uncertainty : Governments and regulatory bodies may impose new laws or regulations that may negatively affect the cryptocurrency market.

- Safety Risks : Cryptocurrencies are susceptible to hacking, theft and other safety threats.

conclusion

Calculating ROI in the cryptocurrency can provide valuable views on potential return on invested capital. Understanding how to calculate the return on invested capital and select the right encryption currencies for your portfolio, you can make conscious decisions about investing in this rapidly developing market.