The Future of Peer-to-Peer Trading in Cryptocurrency

The World of Cryptocurrency has Undergone Tremendous Growth and Innovation in recent years, with the rise of decentralized digital assets. One of the most exciting development is the Emergence of Peer-to-Peer (P2P) Trading in cryptocurrency, which has the potential to revolutionize the way we buy, sell, and trade cryptocurrencies. In this article, we will explore the concept of p2p trading in cryptocurrency, its benefits, and what it mean for investors.

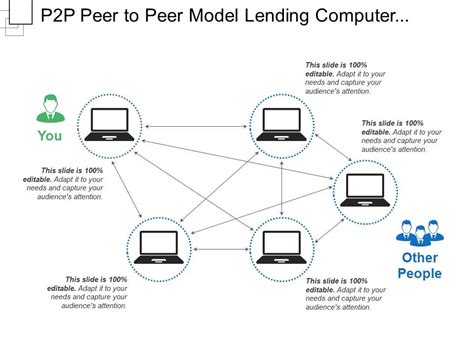

What is peer-to-peer trading?

Peer-to-peer Trading refers to the process of buying or selling digital assets between individuals directly without using a centralized exchange or broker. This Allows for Faster, Cheaper, and More Secure Transactions Compared to Traditional Exchanges. In P2P Trading, Buyers and Sellers Interact Directly With Each Other, Eliminating the Need for Intermediaries Like Brokers.

Benefits or P2P Trading

The Benefits of P2P Trading in Cryptocurrency Are Numerous:

- Increased Security : Direct Transactions between Individuals Reduce the Risk of Hacking and Manipulation by Central Exchanges.

- Faster Transactions

: P2P Trading Enables Instant Confirmation, Reducing Transaction Times to Mere Seconds or Minutes.

- Lower Fees : Transaction fees are typically lower for p2p trades compared to traditional exchanges.

- Greater Autonomy

: Buyers and Sellers Have More Control over Their Transactions, Allowing for Greater Flexibility.

- More Accessible : Cryptocurrency is accessible to anyone with an internet connection, regardless or geographical location or financial status.

Key Players in P2P Trading

Several Key Players Are Emerging in the P2P Trading Space:

- Decentralized Exchanges (Dexs) : Dexs Like Uniswap, Sushiswap, and Balancer Provide A Platform for P2P Trading and Sacrack Pools to Reduce Fees.

- Decentralized Finance (Defi) Platforms : Defi platforms Like Compound, Aave, and Makerdao Enable Lending, Borrowing, and strike of cryptocurrencies, Levering decentralized governance models.

- Peer-to-peer Marketplaces : Peer-to-peer Marketplaces Like Kraken, Binance, and Huobi Offer A Range of Cryptocurrency Trading Services, Including P2P Trading.

Advantages of P2P Trading

- Improved efficiency : Direct Transactions Reduce the Need for Intermediaries, Making Trades Faster and More Efficient.

- Increased Transparency : Buyers and Sellers can View Transaction History and Confirmmations Directly On Their Wallets or Exchanges.

- Enhanced Security : More individuals are invested in blockchain security, reducing the risk of hacking and manipulation.

Challenges and Limitations

While P2P Trading Has Numerous Benefits, There are also Challenges to Consider:

- Scalability Issues : Currently, P2P Trading is not Yet Scalable Enough to Meet Demand.

- Regulatory Uncertainty : Governments May introduction Regulations that Impact the P2P Trading Ecosystem.

- Security Risks : While Security Risks are decreasing with Each Passing Day, They Are Still Present in Any P2P Transaction.

Conclusion

The Future of Peer-to-Peer Trading in Cryptocurrency is Bright. As the Space Continues to Evolve and Mature, We Can Expect:

- Increased adoption : More individuals Will Participate in P2P Trading, Driving Demand and Innovation.

- Improved infrastructure : Decentralized Exchanges, Dexs, and Defi Platforms Will Become More WideSpread, Enhancing User Experience.

- Enhanced Security : the use of advanced cryptography, Such as multi-sig wallets, will improve security and reduce the risk of hacking.

In Conclusion, P2P Trading in cryptocurrency has the potential to revolutionize the way we buy, sell, and trade digital assets.