The importance of economic indicators in Bitcoin trading (BTC)

In the world of cryptocurrency trading, Bitcoin (BTC) is one of the most negotiated assets on online scholarships. With its constantly fluctuating price, traders must be aware of various economic indicators to make informed decisions and increase their success songs. In this article, we will explore the importance of economic indicators in Bitcoin trading and provide you with a complete guide on how to use them.

** What are economic indicators?

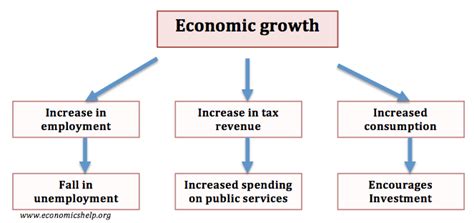

Economic indicators are statistical measures that describe the overall health of an economy or market. They give an overview of factors such as inflation rate, interest rates, employment rates, GDP growth, etc. In the context of the trading of cryptocurrencies, economic indicators are used to assess the feeling of the market, predict price movements and identify potential trend inversions.

** Why are economic indicators important in the Bitcoin trade?

Merchants using Bitcoin for investment purposes must consider a series of economic indicators when making their decision -making. Here are some reasons why:

- Analysis of feelings : Economic indicators can reveal the global feeling of the market, as if investors are optimistic or pessimistic about the future prospects of Bitcoin.

- Identification of trends : By analyzing economic indicators, traders can identify market trends and predict potential price movements.

- Risk management : Understanding the underlying economic factors can help traders manage risks by identifying potential inversions or market corrections.

- Predictive modeling : Economic indicators can be used to build predictive models that provide for future prices or bitcoin.

Key economic indicators for Bitcoin trading

Here are some key economic indicators that traders use during trading Bitcoin:

- Inflation rate : The inflation rate measures the rate at which the prices of goods and services increase.

* Low inflation (less than 2%): stable market, low volatility

* High inflation (more than 5%): volatile market, price correction potential

- Interest rate : Interest rates affect loan costs, which can have an impact on demand and Bitcoin price.

* Lower interest rate: higher demand, higher prices

* Higher interest rate: drop in demand, drop in prices

- Employment rate

: The employment rate measures the number of jobs created in an economy.

* Strong employment rate: Optimistic market feeling

* Low employment rate: feeling of the pessimistic market

- GDP growth : GDP growth measures the rate at which the economy of a country is developing.

* Strong GDP growth: increase in Bitcoin demand, price increase

* Low GDP growth: Decrease in Bitcoin demand, price reduction

How to use economic indicators in Bitcoin trading

To start with the use of economic indicators in Bitcoin trading:

- Choose the right indicator : Select an economical indicator that aligns your trading strategy and your risk management approach.

- Monitoring economic data regularly : Keep a trace of economic data regularly, such as weekly or monthly reports of government agencies and central banks.

- Use technical analysis tools : use technical analysis tools, such as graphics and indicators, to identify trends and models on the market.

- Combine with a fundamental analysis : Use economic indicators in conjunction with a fundamental analysis, such as the news and the feeling of social media, to form a more complete vision of the market.

Conclusion

In conclusion, economic indicators play a crucial role in Bitcoin Trade (BTC). By understanding key thesis indicators and how to use the effective theme, traders can make informed decisions and increase their chances of success.